We design IT infrastructure synergizing business and operational plans to fund enterprises for growth, operations, marketing, and infrastructure. These are vital to the success of the enterprise. With our expertise in business planning, we can assist in difficult financing situations, or where other efforts have failed. Many small to medium sized businesses lack sufficient access to the capital they need to fund operations or grow because of insufficient business planning. Millennium provides management consulting and financial advisory services for enterprises advancement. We work with our clients to identify, source, structure and execute diverse and innovative finance transactions.

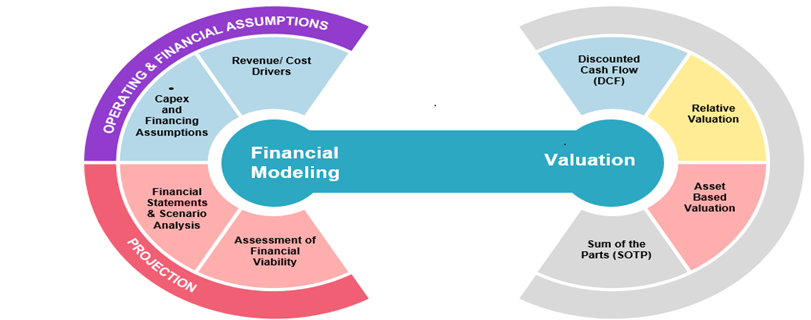

The financial modeling process aids in structuring and combining historical and projected financial information to make business decisions. Financial modeling is one of the most highly valued, but thinly understood, skills in financial analysis. The objective of financial modeling is to combine managerial, financial, and forensic accounting practices to create budgeting, forecasting, and analysis of a company’s planned and future results. More advanced types of models can be built such as discounted cash flow analysis (DCF model), leveraged buyout (LBO), mergers and acquisitions (M&A), and sensitivity analysis.

We provide AI enhanced business intelligence and data analytics services for increased competitive advantage including risk management, data integration, software design, testing and Implementation, data quality life cycle initiatives, and performance driven management solutions!

Business Intelligence includes the processes, methodologies, infrastructure, and current practices used to transform business data into useful information and support business decision-making and risk management programs. We research the latest developments in enterprise efficiency to keep you on the forefront of best data management practices.

We utilized myriad technologies in data management planning including Oracle, SAP, and IBM databases, Business Warehouse, Excel Pivot Tables, Business Objects Analysis, SQL, Crystal Reports, Business Objects Dashboards, Tableau, SPSS, RapidMiner,

Thank you kindly for your interest in our services we look forward to talking with you!

Main Switchboard

Please email us with any questions or to request services!

You must be logged in to post a comment.